The following information is provided by Mary Elizabeth Himes, owner of Safe Harbor Agency in Oak Harbor, Washington. For additional questions about insurance, she may be reached at (360) 675-6663.

Welcome to Fall everyone and to all the excitement that it brings. Halloween, Veterans Day, Thanksgiving, Hanukkah, Christmas, Kwanzaa, Navy Birthday, Presidents Day, Pearl Harbor Remembrance Day, Black Friday and New Year’s Eve.

The mild weather of sunshine and warm breezes are fading away to grey skies and stormy winds. We love the way the seasons move through the Pacific Northwest, there is no doubt when the weather is about to change, its beautiful and exciting. It’s also a time to make certain that your insurance needs are in place and cover what you expect it to.

This spring and summer there were many serious incidents involving vehicles and residences, accidents that resulted in loss of property or someone was injured. To those of you reading this that understand the impact of unexpected events disrupting your lives. Reach over and tap your neighbor, friend or family member who doesn’t. Being prepared as much as possible can save thousands of dollars, reduce mental stress, help protect and maintain a normal standard of living and provide an overall peace of mind.

Since the beginning to 2021 some of the issues that affected our clients were:

- 1-Fire- Insureds displaced for over a year – Cost 400,000+

- 1-Water Damage- Insureds displaced for 2 weeks- Cost 10,000

- 2-At Fault Car single car – on own property – Cost 2500-5500+

- 4-No fault car accidents/Hit and Run- Cost-1300-3400

- 5 -Cracked windshields/falling objects on car-Cost- 200-1500

- Damage by trespassers- Cost 2000+

These are items that were reported to our office, and we are certain that some losses went unreported either because the loss was too small, insured handled it themselves or unfortunately there was no coverage. A vehicle having not enough or no coverage is a risk many people decide to take by deciding to reject medical coverage, windshields or physical damage because of costs. However, when a loss does occur, and repair is required to operate the vehicle all savings may become irrelevant because the out-of-pocket amounts are high.

When it comes to home, renters and landlord insurance it is important to be reminded of the following:

- If your name is not on the policy and you are not a spouse, YOU and YOUR belongings are not covered. Roommates are not covered.

- Personal property is covered for loss even away from your residence.

- Car insurance does not cover items stolen from your car.

- Renters’ insurance is on average 15.00 per month and provides coverage to belongings and coverage to live somewhere else if your domicile is uninhabitable due to fire, smoke or water damage.

- Certain dog breeds are excluded from coverage and entire policy can be declined if dog breed is in home.

- A homeowner or renters’ insurance is NOT and UMBRELLA policy.

- In the event of a covered loss payments are made to you AND the MORTGAGE company.

Staying on top of your coverages is important and you should follow up with your agent annually to go over what you’re paying for and understand your exposures. Having proper coverage will allow you to maintain the life that you’ve built so far.

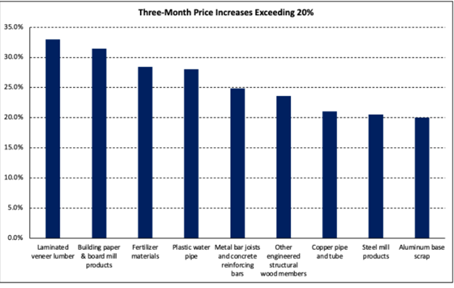

ALERT!!! $150,000.00 will not rebuild your 1000sq ft home, it’s NOT enough and those days are gone. Look into your dwelling coverage and make CERTAIN you have updated the dwelling coverage; you save NOTHING if you can’t rebuild or pay off the house. Homeowners should follow up with their carriers to make certain that the dwelling coverage is sufficient to rebuild the home as prices have skyrocketed over the past 12 month.

The National Association of Home Builders advises that, “Some building materials and inputs to building materials have seen especially acute increases over the last three months. Of the goods analyzed here, nine experienced price increases exceeding 20% between April and July:

The length of time that families are displaced from their permanent domiciles has been increased due to labor shortages and supply chain disruptions. Loss of use coverage is extremely important as it covers Room and board, clothing, food and in some cases transportation.

We still have some sunny days left and we should all be able to enjoy them. Peace of mind will allow a few more smiles in your family. It’s all affordable by reallocating certain financial priorities in your daily routines and a bit of a mindset change.

Think more in terms of how much you can afford to lose than how much does it cost to keep it.

If we’ve learned anything during these times is that uncertainty does not ask permission to enter our lives. So being proactive instead of reactive will go a long way in maintaining stability.